A few years ago, I read about the concept of Bayesian Updating related to investing. I learned Bayes Theorem in college. I never saw it applied to investing. Here’s an official definition of Bayesian statistics:

Bayesian statistics is an approach to data analysis based on Bayes’ theorem, where available knowledge about parameters in a statistical model is updated with the information in observed data.

There are some pretty complex equations associated with this as well. We will review them… never.

I mean, I have not done calculus in over 30 years. I don’t think I could integrate if I tried. Sad to say, my advanced math skills have lapsed.

Lucky for us, you don’t need advanced math to understand the concept. Used in statistics-based models, this theory says that as more data becomes available, you should update your model; therefore, its results will change. Intuitively this makes a lot of sense. And to a degree, it is a part of any good analysts process:

Build your financial model.

Get updated data: quarterly sales, management projections, changes to economics like margins, COGs, etc.

Re-run your model.

Compare the output to the current price and make recommendations.

I became enamored with applying this on a more qualitative level. I looked at a relatively new company with unproven technology. I liked the company, I liked the industry that it operated in, I liked the management, and I liked the technology. I didn’t particularly like that it was unprofitable and was essentially entering the commercialization phase of its operation.

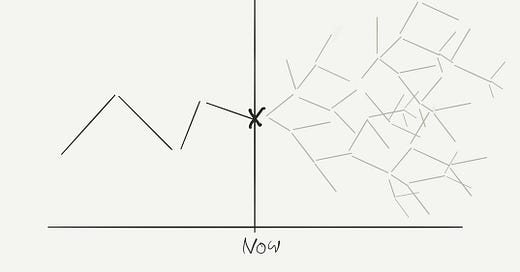

I thought I would use this company to test qualitative Bayesian updating. I’m generally pretty skeptical and don’t typically invest in companies that are all hype and have no history. But in this case, I thought it was promising enough to take a small position. I would test the process of Bayesian updating by initially assuming a relatively low percentage chance of the company being successful, and I would update my thoughts on the probability of success based on progress reported by the company. I would then update my position size only on the back of positive news from the company.

And the good news was forthcoming; they reported new business partnerships with some leading companies and structured partnership agreements with manufacturers to include their technology as a purchase option on new equipment. They even made several relatively large sales. I incrementally added to my position for several years whenever they reported good news. Slowly it became a much larger percentage of my portfolio. In retrospect, it was too large. Eventually, the stock started to drop, and I took a significant loss on my position. I was taken in by the bane of many micro-cap companies: overly optimistic management. When I go back through my process, many things that I thought were updates were just fluff. Slightly positive news, yes, but nothing that changed the company's trajectory. When I thought I was Bayesian updating, I was filling my head with noise from the company. This certainly changed how I felt about it, but not their odds of success.

I learned a lot from this experience. In the future, I will do it much differently. Here are a few of the lessons. I hope that sharing them may help you prevent some of the same mistakes that I made:

Ignore the fluff. Some companies will do a press release on every employee's birthday. Determine the critical criteria for the company’s success and only update your thinking when one of those criteria is impacted. For example: in this company’s case, I should have focussed on information regarding sales. Sales would drive the thesis, and data about sales would validate it.

Buy up. If this thinking works correctly, you should not be the only one seeing positive developments. In my example, I bought over years, and the stock price stayed in a pretty well-defined range. In retrospect, this is probably a good sign that what I thought were positive developments weren’t positive enough to move the needle.

Focus on operational metrics. I prefer hard data. Although this process is not quantitative - you are making an educated guess at your odds of success - what you focus on should be measurable. Progress on revenue, gross margin, profitability, and other key operating metrics on which you base your updates.

Patience. The eternal lesson. Things never happen on the timeline you want. Your data points are fewer and less frequent than you hoped. Patience is required to see your process through.

I think Bayesian updating is an excellent mental model for investing. Hopefully, I learned how to apply it better in the future. Also, I am hoping you can learn from my mistakes.

As with many things in investing, easy to say and think but when comes to execution a whole different game . As you said it is “makes sense” but most when when you look back as past is already defined the future is not.

One thing I wanted to add regarding buying (I think it was second) in the range and “maybe you didn’t see and too optimistic while market was not”

I believe there has been many cases where the underline number “have been rising” and yet stock was lagging so maybe this time you were not it doesn’t mean next time you are correct. What I mean just because stock doesn’t move does not mean that company is not executing well