One of the First Tiny Companies I Owned Went Bankrupt

But not before I made 7X my investment...

It’s been a while since I’ve written. More on that later. Let’s get to it.

I don’t usually write about specific companies. A lot of the stuff I invest in is small, tiny even, and illiquid. I don’t really want someone chasing one of these companies and accusing me of trying to pump the price. Or worse, investing a significant amount of money in one of my ideas and then losing it. But in this case, it’s pretty safe since the company I’m discussing went bankrupt.

This is an origin story. Most comic book heroes (and villains) have an origin story. I’ve found investors often have origin stories as well. I’m not saying we're super heroes… You will have to decide that for yourself!

The stock I am discussing is called Nautilus, Inc. (NLS later changing its name to Bowflex). It has its roots in the 80s and 90s when they used to sell exercise equipment called Bowflex directly to consumers. This was pre-Internet, gasp!, and you could order a glossy brochure (in the mail!) featuring fit men and women draped over their minimalist exercise equipment. It may even include a CD-ROM! They were very successful for a while and went public. They purchased the rights to the Nautilus and Schwinn names and, for years, were a successful exercise equipment retailer.

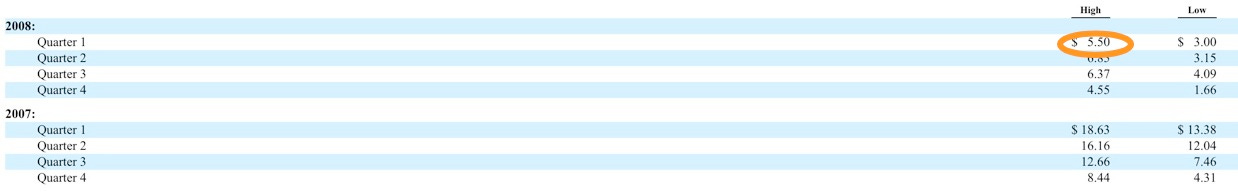

I became interested in 2008. This is mostly from memory and old filings, so while it is directionally correct, I cannot verify the accuracy of all the numbers I will be quoting. (All of the data is from their old SEC filings.) Nautilus launched a new product that was a drain on corporate resources and proved unsuccessful. The stock price plummeted, and I established a small position while I began researching the company. Here is a picture from their annual report from the time, and my approximate buy price:

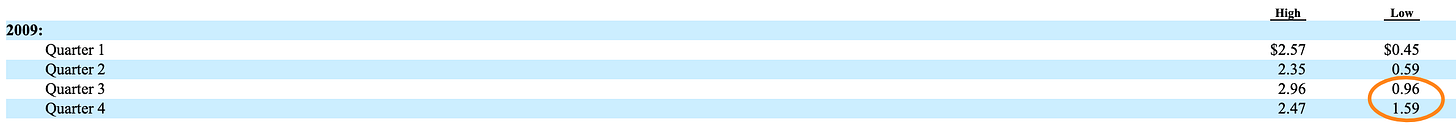

I was buying around $5-6. The company was a bit of a mess and in turnaround mode. They were discussing the purchase of their Chinese manufacturer and vertical integration. Myself and seemingly everyone else associated with the company thought this was a poor idea. An interesting development occurred. A new CEO was appointed to take over. His name was Edward Bramson, and he ran a fund called Sherborne Investors. He was a major Nautilus shareholder. The stock continued to crater. As you can see in the next pic:

I continued buying in the $1-1.50 range. I didn’t have any particular insight; I simply followed the company's progress as the new CEO led a turnaround. There was some existential question of survival while they were laboring under the previous plan to buy their supplier. The debt or dilution would likely have led to the company's demise. However, Bramson was opposed to the plan. Eventually, they were able to exit the commitment. I believe they had to pay a cancellation penalty, but the amount wasn’t life-threatening.

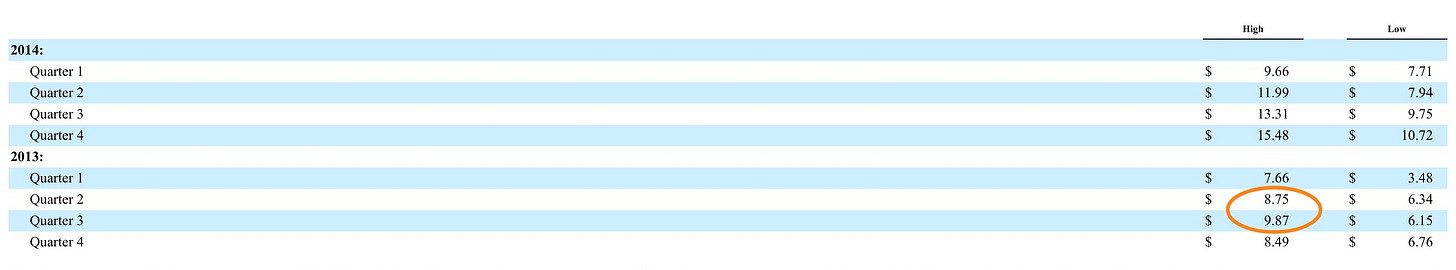

Nautilus continued to do sensible things, such as hiving off their unsuccessful product and winding it down, cutting costs, and focusing on their core profitable business lines. As the threat of bankruptcy receded, Bramson stepped down from his CEO role and handed the company over to a successor. The stock price recovered over the next few years, and I sold my stake. Here’s where we ended up:

I sold in the $8-9 range. Although my first purchases were $5-6, the bulk of my purchases were in the $1-1.50 range. I distinctly remember the 7X on my investment. That type of gain sticks with you.

Over the fullness of time, Nautilus stumbled again. But this time I did not invest. Ultimately, they went bankrupt in March of 2024.

There are several things I learned from this investment experience, both at the time and in retrospect:

Follow the Business: Nautilus was early in my investment career, and one of the first microcap companies that I took a substantial stake in. I simply listened to the conference calls, read transcripts and filings, and kept up with what the company was doing. They continued to do things that I thought were sensible. As long as they continued to make rational decisions, I held the stock.

It Takes Time: This all unfolded over a period of 4-5 years. I have discovered since then that you occasionally get a quick, significant return. However, most investments I make typically take 2-5 years to work out.

Turnarounds Sometimes Work: We all know that the problems with a turnaround is that it seldom turns around. But sometimes they do! Over time, I have come to view this take on turnarounds with some skepticism. For the most part, I think the “turnarounds don’t turn” crowd steeped themselves in the history of large companies. From experience, I know that turning a large company around is a difficult and culturally challenging issue. With microcaps, however, the story is different. These smaller companies are much more likely to respond more quickly to efforts to right the ship. A single CEO or activist investor is often highly successful in instituting turnaround efforts.

You Can Make Money in Mediocre Businesses: I learned this years after investing in Nautilus. Truth be told, I don’t remember thinking much about the quality of the business while I was invested in it. I was following the progress. Years later, I looked at them again and realized how poor a business this was in the long term. Low returns on capital, despite being capital-light. I pieced together some of their marketing data and realized that the Nautilus spent approximately 30% of its revenue on marketing, which is just a portion of its SG&A costs! Any stable company spending 30% of its revenue on marketing—and not growing substantially—is peddling a product that needs to be sold, not something the customer needs to buy. In general, I try to stick with companies that are good intrinsic businesses now, but occasionally, there are situations where even a poor business can generate great returns.

Investing in Nautilus taught me the rewards of following a company’s fundamental progress. I also learned the great potential that lies in the small, undercovered corners of the market. Hopefully, sharing the lessons learned will help you on your investing journey.

On a personal note, my family and I just returned from living in Stockholm, Sweden, for the last four years! We're enjoying being back in the San Francisco Bay Area. If anyone is in the hood and wants to chat, virtually or in real life, drop me a note!

Kudos to you for continuing to follow the company and adding as they executed.