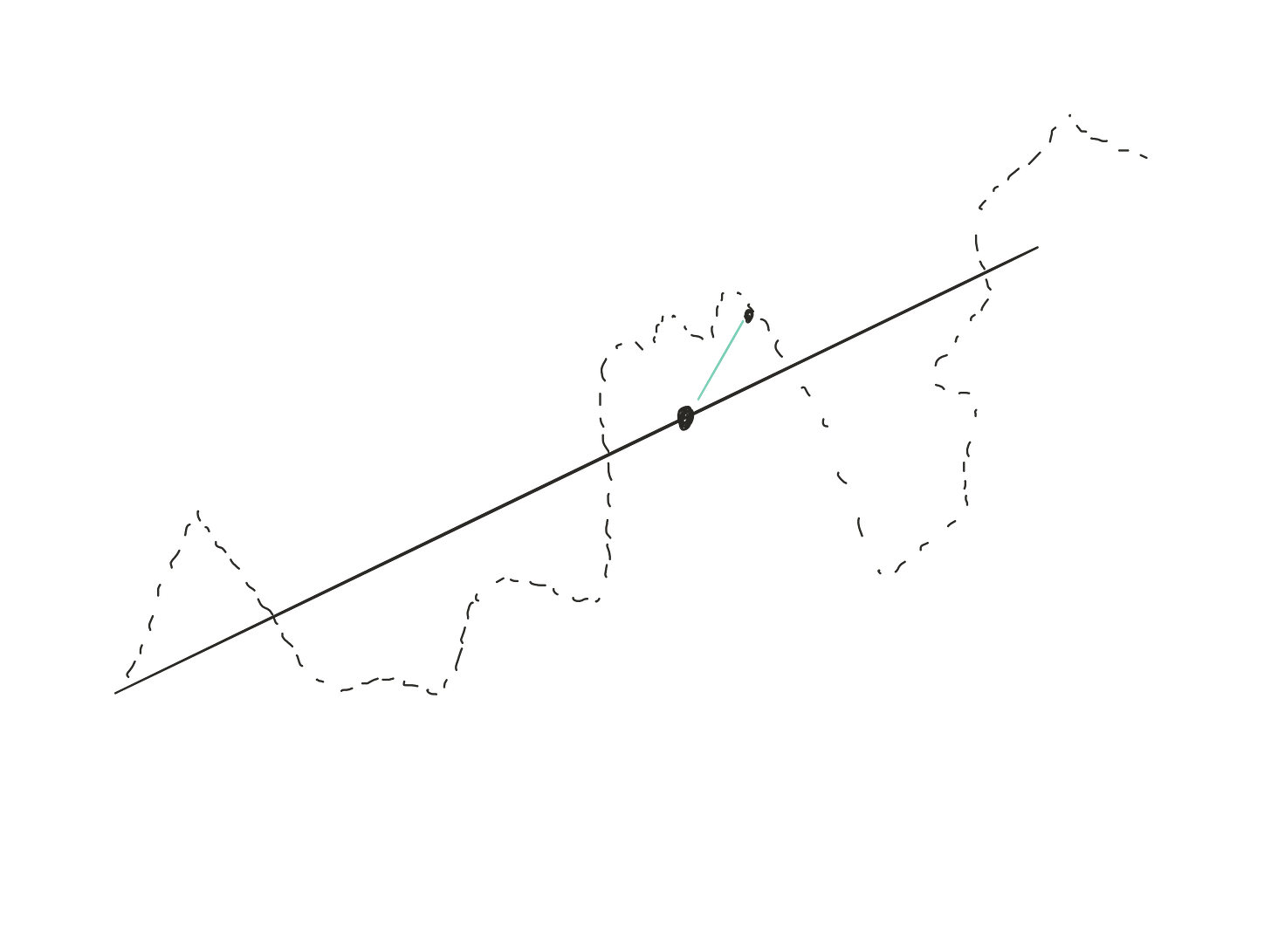

The best analogy I’ve ever heard for investing in a company’s stock is walking a dog. It goes like this: Imagine you are taking your dog for a walk down your favorite forest path. You are walking along blissfully, following the path. But the dog is all over the place, thanks to your retractable leash. Beside you, behind you, to the left… right. If you drew a picture with a dog on a green leash, it might look a little something like this (except your picture would be better):

You wander a straight path, but the dog moves randomly around your direction. Ultimately, you both get to your destination. This is an excellent investing analogy: the dog is the price of a company you are investing in. The company moves steadily, but the price moves all around the direction of the company’s intrinsic value. Sentiment, news, interest rates, industry news, etc push it. I didn’t invent this analogy (although I wish I did), but I can’t remember who I heard it from for the life of me. If you know, give a shout-out in the comments so we can give the appropriate recognition.

In simple terms, what I am trying to do is constantly project out where I think the company will be in 2-5 years and decide what a “fair” price to pay for that would be. I’m not very precise, so I tend to think more in valuation bands—a range where it would be a fair price. Then, if it is significantly below that band, I buy some. If it is above that band, I sell. The type of business that I own really determines how much buying and selling goes on. If a holding has good long-term prospects, I will sell a little - or none. If it is more of a value play where I buy because the price is very depressed, but I’m not thrilled about the long-term company prospects, I sell a significant chunk or all of it. It might look a little something like this:

Most of the time, you do nothing; the dog is in your “fair” range. This is a great mental model for me. I think about it often when I am thinking about buying or selling. Often, I decide not to do anything after “taking the dog for a walk.”.” Recently, I have made a fair number of “trim” decisions. Selling a small amount of holdings because I think they are on the upper side of their range. It’s an excellent situation; prices have run up recently. But I have this feeling that at a portfolio level, maybe it looks something like this:

I’m not sure how to feel about this exactly. I have a tendency to worry when times have been good—investing-wise. And now certainly fits that bill, but on the other hand, I’m terrible at prognosticating on a macro level and have proven that I have no ability to time markets.

I have no grand conclusions. I just thought I would share. Feel free to drop any feedback in the comments!

As always very interesting and I seem to think similarly to you although been also trying to develop thinking of having more flexibility and rigidity simultaneously depending how things are developing both short and long term (if that makes sense)

This was the classic story of André Kostolany, the old speculator from Hungary. He was the greatest story teller, when it comes to investing. He died around 2000, right before the internet bubble bursted.